Skills in the LinkedIn Professional Pricing Society Group

Steven Forth is a co-founder of TeamFit. See his TeamFit skill map

This is one of TeamFit's occasional reports on skill trends in important industries and business functions.

Pricing is one of the most important business functions, though often overlooked in more general discussions of skills. The Professional Pricing Society holds its fall meeting this week in San Diego October 24 to 27, 2017) and this seems like a good time to see what skills are common among people who engage in pricing. At TeamFit, we are especially interested in this as we work closely with the market segmentation and pricing consulting firm Ibbaka.

There are a number of LinkedIn groups focused on pricing, including Pricing the Internet of Things, Strategic Pricing for Mid-Market Companies and the Network of Pricing Champions. There are even some strong local groups like Silicon Slopes Pricing.

The largest is that of the Professional Pricing Society, with just over 15,000 members. To get a feel for the skills of people in this group we pulled a random sample of 400 people, which given the group's size should be enough to be statistically significant) and uploaded the data into TeamFit.

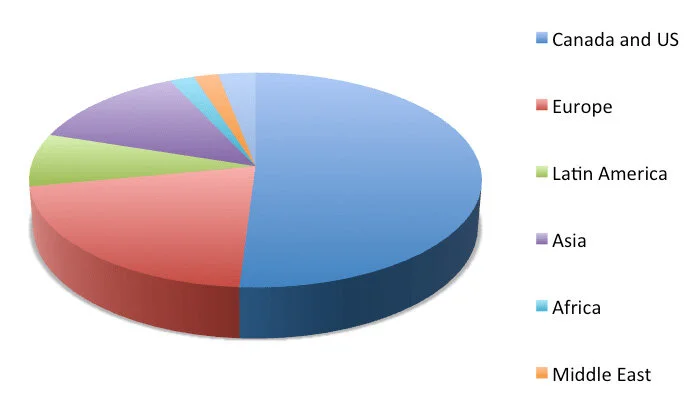

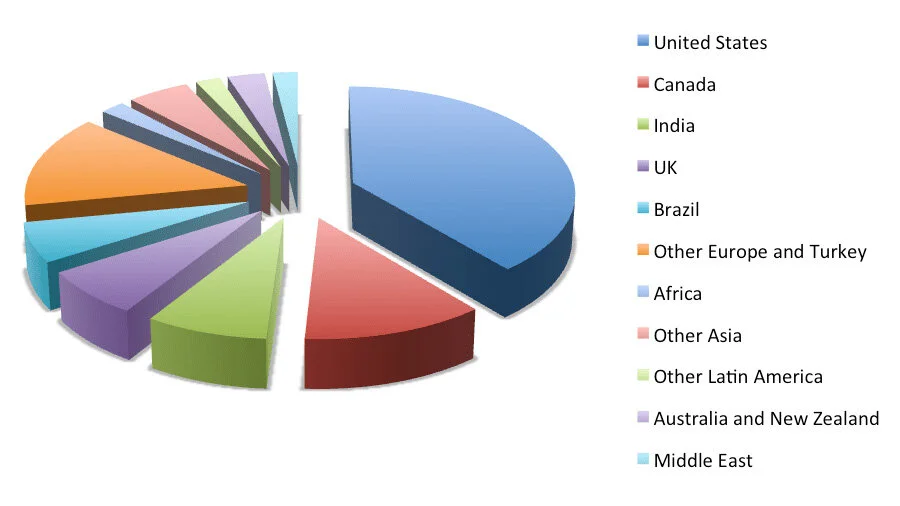

The geographical distribution of the sample is shown below. It would be interesting to know how this maps to the Professional Pricing Society's actual membership (one can join the group without being a member of the Professional Pricing Society and not all members of the society have joined the group).

Looking a bit more closely, we can see that the US is, not surprisingly, the largest largest group, followed by Canada. The Professional Pricing Society is an American business, but it does have an annual event in Europe and has had events in Asia.

In this 400 person sample, we found 1,365 different skills. Now of course not all of these skills are directly related to pricing, and not all of them will be used on pricing projects, but the range is still impressive. The preponderance of the skills are business related, 711 of the total. See the word cloud for Business Skills below.

There are also a great many Domain Skills, 205. It seems that the Management Consulting, Telecommunications and Pharmaceuticals are the top three areas of domain expertise. Looking down the list, one finds a great many skills associated with the top group. For example, in addition to Pharmaceuticals one finds skills such as Biotechnology, Medical Devices, Oncology. Healthcare, and Health Economics (an important skill for people involved in pricing in healthcare.

The top Technical Skills were around Analysis and Analytics or Business Process Improvement and Business Intelligence.

Pricing is generally seen as a technical discipline, dependent on a great deal of analysis. So it is not surprising that there were relatively few Design Skills in this sample of 400 people. There were nine people with Digital Media, five with Creative Direction and just three, less than 1% with User Experience. I will have more to say about this below.

One of the most important skill categories is Foundational Skills.

These are the skills that careers are built on long-term and which support the development of other skills. I was expecting to find more math and reasoning skills. The only one that I found is Statistics. There did seem to be a focus on Leadership, Team Leadership and Team Management. This is a good thing as pricing is increasingly complex, requiring teams and collaboration.

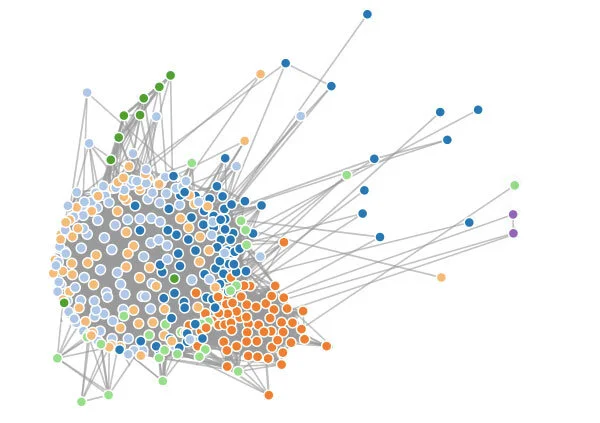

In our skill insight work, TeamFit does a number of additional analyses. One of these is clustering. We are interested in seeing if skills are used together in predictable patterns. The analysis was carried out by David Botta at TeamFit who described it as follows.

The society members share a lot of skills. In order to distinguish members, two members were considered to be related if they shared seven or more skills. Analysis segmented the members into nine non-overlapping groups.* Respectively, the groups had the following sizes: 105, 86, 71, 62, 30, 9, 2, 2, and 2.The skills for the groups are presented below as word clouds. The skills that are most shared within the group come first, and they are largest. Each skill name is followed by the number of people in the group who have that skill. For example: Market_Analysis/49. The more feint a skill is, the less it contributes to distinguishing the group from the overall society.* The community discovery algorithm used always produces non-overlapping groups.

Business Cluster

The largest group, with 105 members (more than 25% of the total) was business focussed:

Strategy/87

Business_Strategy/83

Pricing/74

Management/72

Competitive_Analysis/63

Strategic_Planning/61

Pricing_Strategy/60

Marketing_Strategy/59

Analytics/56

Business_Planning/52

Marketing/51Market_Research/51

Segmentation/50

Market_Analysis/49.

(Good to see 'Segmentation' showing up as a skill here.)

Project and Analysis Cluster

This was followed by a group of 86 people who were also business focussed, but with more of a project emphasis:

Management/67

Strategy/50

Project_Management/48

Analysis/46Strategic_Planning/43

Pricing/41Process_Improvement/41

Business_Strategy/39

Change_Management/36

Negotiation/35

Business_Process_Improvement/35

Project_Planning/33

Forecasting/31

Product Management Cluster

The third group had 71 members and seems to work in product management and related areas.

Management/58

Strategy/58

Product_Management/49

Business_Development/47

Business_Strategy/46

CRM/42

Product_Marketing/40

Recruiting and Talent Acquisition

LinkedIn tends to attract a fair number of recruiters and talent acquisition is a hot topic today. This was the fourth largest cluster with sixty-two members.

Recruiting/58

Management/47

Talent_Acquisition/46

Human_Resources/46

Talent_Management/44

Sourcing/43

Executive_Search/39

The other clusters were smaller. There was a Marketing focussed cluster with 30 members, a Pharmaceutical and Healthcare cluster with 9 members, and three rather poorly defined clusters with only two members each.

What is Missing Here?

There appear to be two large skill gaps here, one in the area of artificial intelligence with its related skills of predictive analytics, deep learning and programming languages such as R and Python. See the post on the Ibbaka site 'What role will AI play in pricing?' Twelve people in the sample did have SPSS as a skill and there were many people claiming Excel. There were a few people with R (seven), Matlab (six) and Python (four). I suppose if one extrapolates from the sample to the group we can expect to find about 270 people with R as a skill, which is not too bad but we are going to have to hire or re-skill a lot of people if pricing is to take advantage of the power of the new artificial intelligence based approaches to pricing and related disciplines.

Personally, I was disappointed by the small number and generic nature of the design skills in this group. Pricing is not just about analysis and optimization. It is a place where there are many opportunities for innovation. Just three people had the upper-level design skill of User Experience. Even extrapolating does not give me much solace here, as that just gives eleven people or less than half a percent.

The critical innovation skill is Design Thinking. Here the LinkedIn Group has almost 100,000 members. We have also done research into skills in this area, and you can read our most recent report here. Profiling the LinkedIn Design Thinking Group's Skills. I checked to see if Pricing showed up in the sample data for this group. Segmentation, Monetization, and Business Model Design all showed up, but not pricing.

I hope to see more and more people who combine Design Thinking and Pricing skills in the coming years. It is part of the skill set that Ibbaka is building, see "Don't Set Prices. Design Pricing!." The large consulting firms such as McKinsey and Deloitte include centres of expertise in Design Thinking and Pricing. I wonder though, in these large firms, how often people in these two areas talk to each other and share expertise.

If you are interested in skill and expertise management and the insights it can give to the skills within your organization or industry please contact us!